Table of Contents

- Tax Planning is for Individuals also…not just for business

- Income Tax Rates Australia 2024 - 2024 Company Salaries

- A Beginner's Guide to Understanding Australian Income Tax 2024 - YouTube

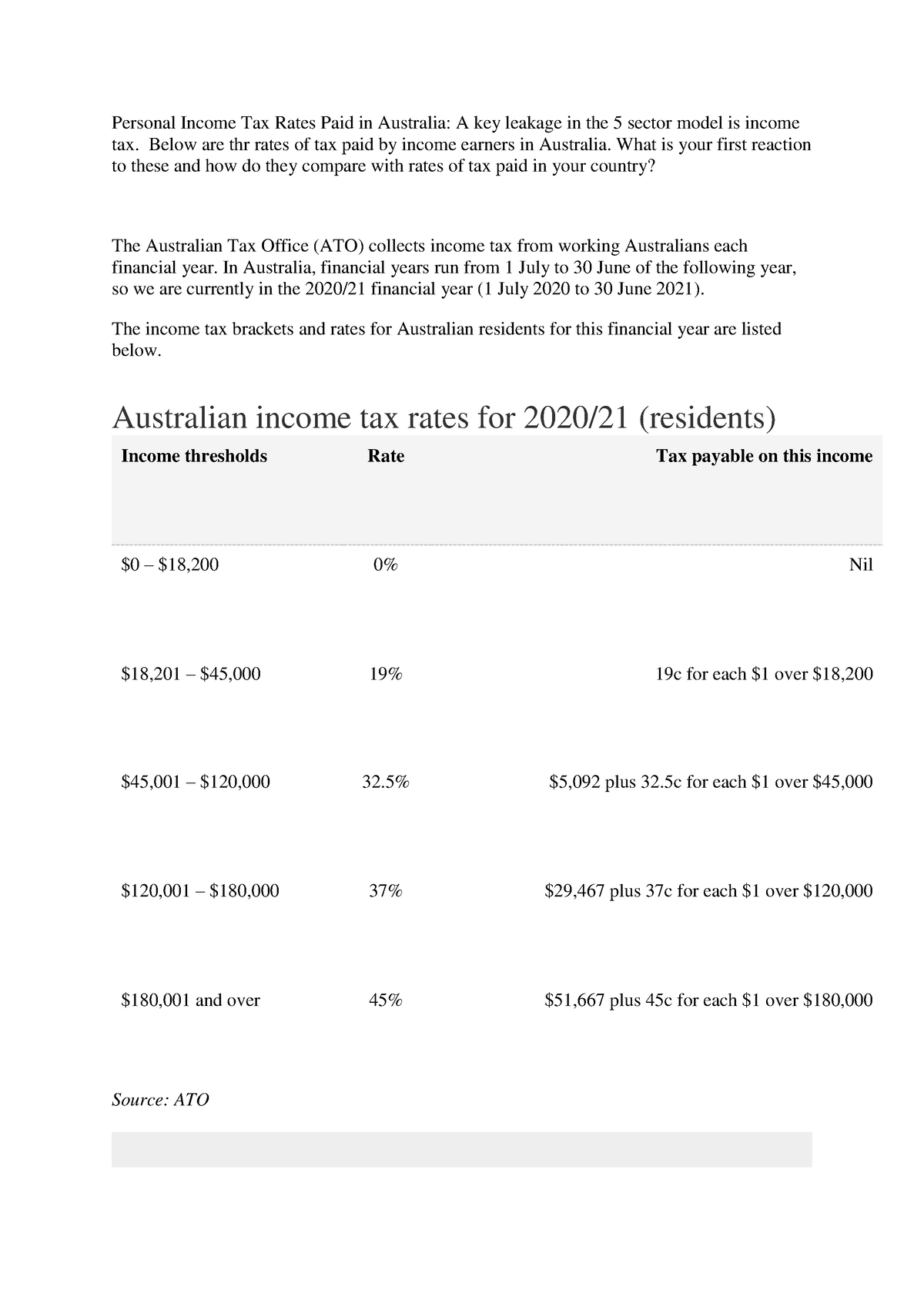

- Reading week 9 Personal income tax rates in Australia - Personal Income ...

- 2025 Vs 2026 Tax Brackets List Of Disney Project 2025 | sexiezpix Web Porn

- Australians are expected to get 00 on average back at tax time ...

- How Do Tax Brackets Work in Australia? | Tax Brackets Explained - YouTube

- Australian Tax Brackets 2023-24 | What Are the Australia Income Tax ...

- Australian Tax System in 2023 - Tax Rate in Australia - YouTube

- AUSTRALIA - New personal income tax rates - BDO

What are Tax Rates?

Tax Rates for 2026-2027

How to Use Taxrates.info

At Taxrates.info, we provide you with a comprehensive guide to tax rates, including tax calculators, tax tables, and detailed information on tax regulations. Our website is designed to help you navigate the complex world of taxation and provide you with the necessary tools to make informed decisions about your taxes. Understanding tax rates for the 2026-2027 year is essential for individuals and businesses alike. By staying informed about the latest tax rates and regulations, you can ensure that you're taking advantage of all the tax deductions and credits available to you. At Taxrates.info, we're committed to providing you with the most up-to-date information on tax rates and regulations. Visit our website today to learn more about tax rates and how they affect you.Stay ahead of the game and plan your taxes in advance. Visit Taxrates.info today and take control of your taxes.

Keyword Tags: tax rates 2026-2027, taxrates.info, tax rates, tax regulations, tax calculators, tax tables

Meta Description: Get the latest information on tax rates for the 2026-2027 year at Taxrates.info. Our comprehensive guide includes tax rates, tax calculators, and detailed information on tax regulations.